Be In The Know

Five Key Takeaways from the Five-Year Forecast for Upcoming Budget Needs

Virginia Beach City Council and School Board get first look at Virginia Beach’s overall financial position for FY 2026-27

The budget process for fiscal year 2026-27 officially kicked off on Nov. 18 during a joint meeting of the Virginia Beach City Council and School Board, as the City’s Department of Budget and Management Services, along with Virginia Beach City Public Schools (VBCPS), presented the Five-Year Forecast.

This year’s meeting included a presentation by Nikki Johnson, regional economist for the Hampton Roads Planning District Commission, on economic trends nationally, regionally and locally in employment, housing, jobs and demographic data. Hampton Roads was especially affected by the federal workforce cuts, Johnson said, because it has the third largest federal workforce in the country. Federal tariffs are increasing prices, but the full effect has not yet taken place, she explained.

Kevin M. Chatellier, director of the City’s Department of Budget and Management Services, gave the first look at the City’s overall financial position, including estimates of revenue from all major general revenue sources, as well as expected expenditures. Crystal Pate, the chief financial officer for VBCPS, presented the Schools’ operating fund forecast.

The forecasts are based on the assumption that all policies, tax rates and the revenue-sharing formula between the City and Schools remain the same. Economic factors and policy decisions could cause them to change and will be monitored closely throughout the five-year forecast period, FY 2027 through FY 2031.

Key Takeaways

Overall economy is stable: Overall the national economy is slowing, but it is stable, and a recession is not expected.

City revenues expected to grow more slowly: Real estate taxes represent 46% of the City’s general revenue, and those are expected to grow over the five-year forecast period, but at a rate lower than the City’s historic average of 5%. In addition, more real estate is exempt from taxes because of the rapid growth in enrollments for the state-mandated tax relief for disabled veterans. Revenues from personal property tax, business licenses, restaurant meals tax, hotel taxes and general sales tax are expected to grow at rates near historic averages, while cigarette tax revenue is expected to decline by 5%.

City expenditures expected to increase: Operating expenditures for personnel are increasing, including for the Virginia Retirement System and health insurance. With inflation at 3%, and salary and fringe benefit increases, expenditures are outpacing increases in the general fund revenues.

School revenues expected to increase: Federal revenue is expected to increase for the first year of the five-year forecast period, then remain flat each of the remaining years. Because revenue from the Commonwealth provides nearly half of the operating budget for Schools, the governor’s proposed budget also will be an important consideration. It will be released in December.

School expenditures expected to increase: Personnel costs, inflation and debt service are increasing. The enrollment of at-risk, special education and English-as-second-language students is rising, as well as social and emotional needs of students, which increases the per-pupil costs.

Council members will continue to review this information in preparation for a retreat planned for January. From now until the adoption of the FY 2026-27 budget in May, projections will be refined and decisions made that will affect the final budget adoption.

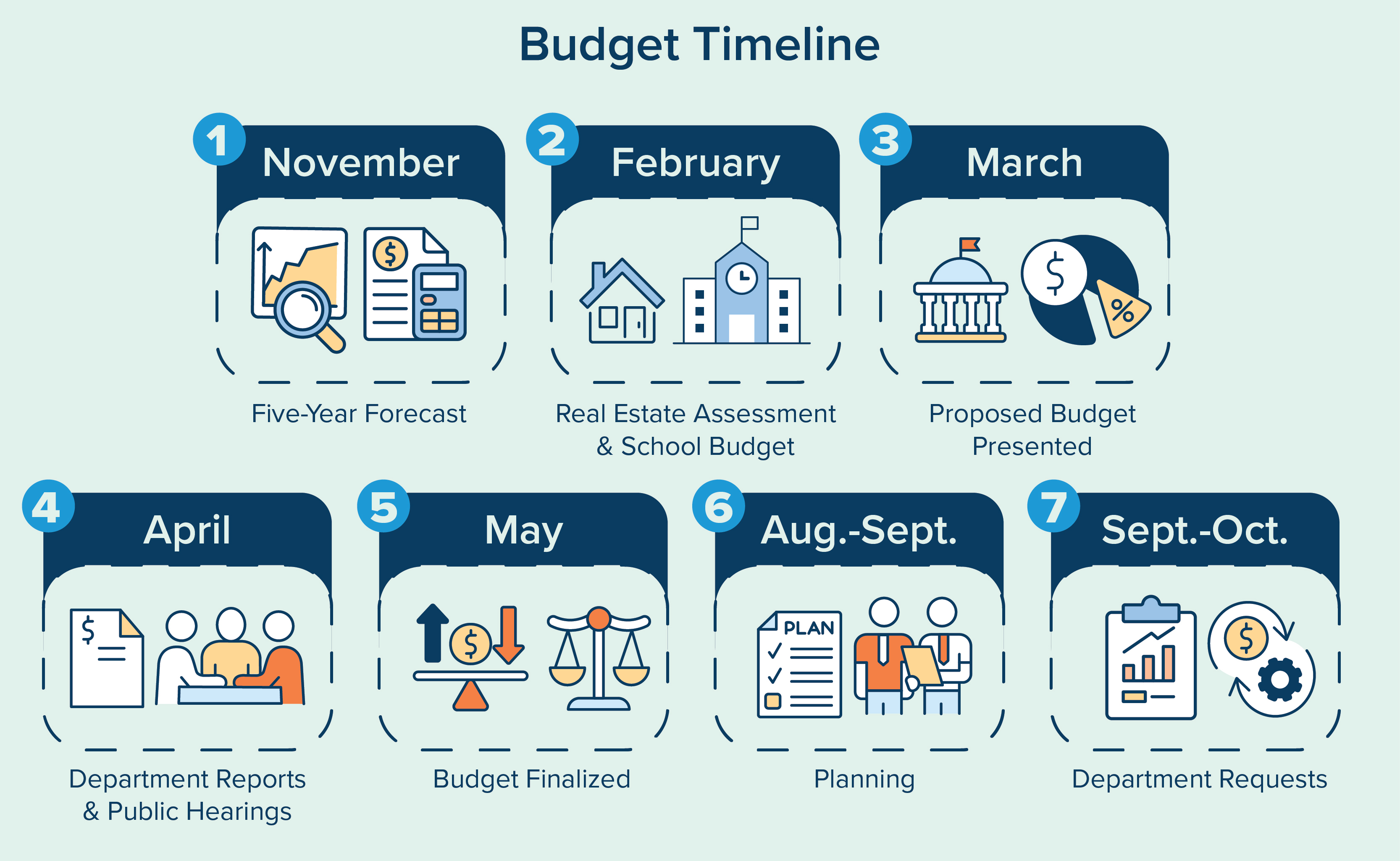

Next Steps in the Budget Process

Leading up to the public hearings for the City’s budget in April and final adoption in May, the budget process follows this timeline:

- February: The City Council and the public receive the annual report of real estate assessments for FY 2026-27, and the Department of Budget and Management Services uses it to update the school funding formula to provide to Virginia Beach City Public Schools. The superintendent will present to the School Board a proposed estimate of needs. VBCPS holds workshops and public hearings before its budget is adopted by the School Board.

- March: The Schools’ budget request is approved by the School Board in March, and the city manager presents the proposed operating budget of both the City and Schools to City Council on March 24. The proposed budget is available for the residents to view at public libraries, City Hall and online at Budget.VirginiaBeach.gov.

- April: City Council hears from individual department directors on their proposed budgets. Two public hearings, scheduled for April 15 and April 21, provide residents an opportunity to comment on the proposed budget. Residents also may comment through online opportunities at SpeakUpVB.com and at Budget.VirginiaBeach.gov as well.

- May: The reconciliation workshop, when City Council and the city manager work out changes to the proposed budget, is a week before the state-mandated deadline of May 15 for the budget to be adopted. It is scheduled to be adopted on May 12, 2026.

Learn more by visiting Budget.VirginiaBeach.gov. Watch the City Council meetings and be prepared to provide your input on the proposed budget. Subscribe now to get updates on the City’s budget process and how you can provide your input before major decisions are made.

Keep Reading

See All Posts-

Calendar News Blog Hot Topics Multimedia Social Media Mobile Apps